About Vancouver Accounting Firm

Wiki Article

The Definitive Guide for Virtual Cfo In Vancouver

Table of ContentsThe Of Virtual Cfo In VancouverAbout Small Business Accounting Service In Vancouver4 Simple Techniques For Tax Consultant VancouverThe Single Strategy To Use For Cfo Company VancouverThe Ultimate Guide To Pivot Advantage Accounting And Advisory Inc. In VancouverFacts About Pivot Advantage Accounting And Advisory Inc. In Vancouver Revealed

Right here are some advantages to working with an accountant over a bookkeeper: An accounting professional can give you a comprehensive sight of your organization's economic state, together with techniques and suggestions for making economic decisions. Bookkeepers are just responsible for tape-recording financial purchases. Accounting professionals are required to finish even more schooling, certifications and also work experience than bookkeepers.

It can be challenging to gauge the appropriate time to work with an accountancy professional or accountant or to identify if you require one in all. While many tiny businesses work with an accountant as a specialist, you have a number of alternatives for managing monetary jobs. Some little company proprietors do their own accounting on software application their accountant advises or makes use of, supplying it to the accountant on a weekly, month-to-month or quarterly basis for activity.

It might take some history research to discover a suitable bookkeeper due to the fact that, unlike accountants, they are not called for to hold a professional certification. A strong recommendation from a trusted coworker or years of experience are essential aspects when hiring a bookkeeper. Are you still not exactly sure if you need to work with a person to assist with your publications? Here are three instances that show it's time to employ a monetary expert: If your taxes have actually ended up being as well complex to take care of by yourself, with several earnings streams, international investments, numerous deductions or other considerations, it's time to employ an accounting professional.

About Outsourced Cfo Services

For small companies, skilled cash management is a critical element of survival and growth, so it's a good idea to function with a monetary professional from the beginning. If you prefer to go it alone, take into consideration starting with audit software as well as keeping your publications meticulously approximately date. By doing this, should you require to hire a specialist down the line, they will certainly have visibility into the total financial background of your service.

Some source interviews were conducted for a previous variation of this write-up.

The Ultimate Guide To Small Business Accounting Service In Vancouver

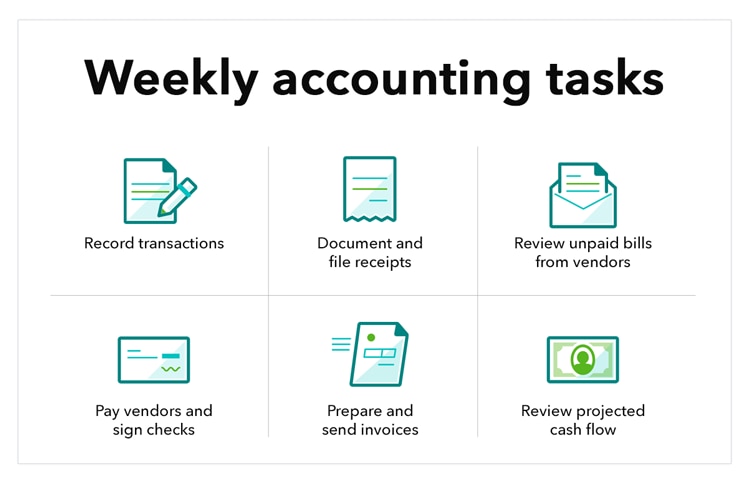

When it comes to the ins and outs of taxes, accountancy and financing, however, it never ever harms to have an experienced specialist to resort to for support. An expanding number of accounting professionals are additionally looking after points such as capital forecasts, invoicing and also HR. Ultimately, most of them are tackling CFO-like duties.Small company proprietors can expect their accounting professionals to assist with: Choosing the service structure that's right for you is very important. It impacts just how much you pay in tax obligations, the paperwork you require to submit as well as your individual obligation. If you're seeking to transform to a different business structure, it might result in tax effects and various other issues.

Also companies that coincide dimension and also industry pay really various amounts for accountancy. Before we get involved in dollar figures, allow's speak about the expenses that enter into small company bookkeeping. Overhead expenditures are expenses that do not straight become a revenue. These expenses do not convert into cash money, they are necessary for running your company.

The Ultimate Guide To Outsourced Cfo Services

The ordinary cost of audit solutions for little company differs for every unique situation. However given that accountants do less-involved tasks, their prices are typically more affordable than accountants. Your financial solution charge depends on the work you need to be done. The ordinary regular monthly bookkeeping fees for a local business will climb as you add much more solutions and also the tasks get more difficult.You can tape transactions as well as procedure payroll making use of on-line software. You get in read the article amounts right into the software application, and also the program computes total amounts for you. In many cases, payroll software for accountants allows your accounting professional to supply payroll processing for you at really little added cost. Software application solutions come in all shapes as well as dimensions.

:max_bytes(150000):strip_icc()/forensicaccounting-Final-85cc442c185945249461779bcf6aa1d5.jpg)

The Best Guide To Virtual Cfo In Vancouver

If you're a new local business owner, do not forget to aspect bookkeeping prices right into your spending plan. If you're a professional owner, it could be time to re-evaluate accounting prices. Administrative prices and also accountant charges aren't the only accountancy costs. small business accountant Vancouver. You need to also take into consideration the effects bookkeeping will certainly have on you as well as your time.Your ability to lead employees, serve customers, my blog as well as choose might experience. Your time is also useful and also should be considered when looking at accountancy costs. The time invested on accounting tasks does not create earnings. The much less time you spend on bookkeeping and taxes, the even more time you need to expand your organization.

This is not meant as legal guidance; for more information, please go here..

The 6-Minute Rule for Vancouver Accounting Firm

Report this wiki page